Abolition of Income Tax and its momentous consequences: A summary of reforms proposed in Comité Bastille’s TNA (Tax on Net Assets) Project, and in André Teissier du Cros’s two books:

La Taxe sur l’Actif Net ou Impôt Progressif sur le Patrimoine Dormant (Tax on Net Assets, or Progressive Tax on Inactive Wealth), Ed. L’Harmattan, 2016

La France, le Bébé et l’Eau du Bain (France, the Baby and the Bath Water), Ed. L’Harmattan, 2010.

November 2013 updated April 2015, October 2016, November 2018, February and May 2020.

La France, le Bébé et l’Eau du Bain (France, the Baby and the Bath Water), Ed. L’Harmattan, 2010.

November 2013 updated April 2015, October 2016, November 2018, February and May 2020, April 2021.

More than ever since the Covid-19 pandemics, and now that the world debt is geoting closer to total world wealth, we must shift taxation from income tax to wealth tax.

Income tax, through financialization, keeps amplifying inequalities, world debt, total energy consumption, and tax optimization.

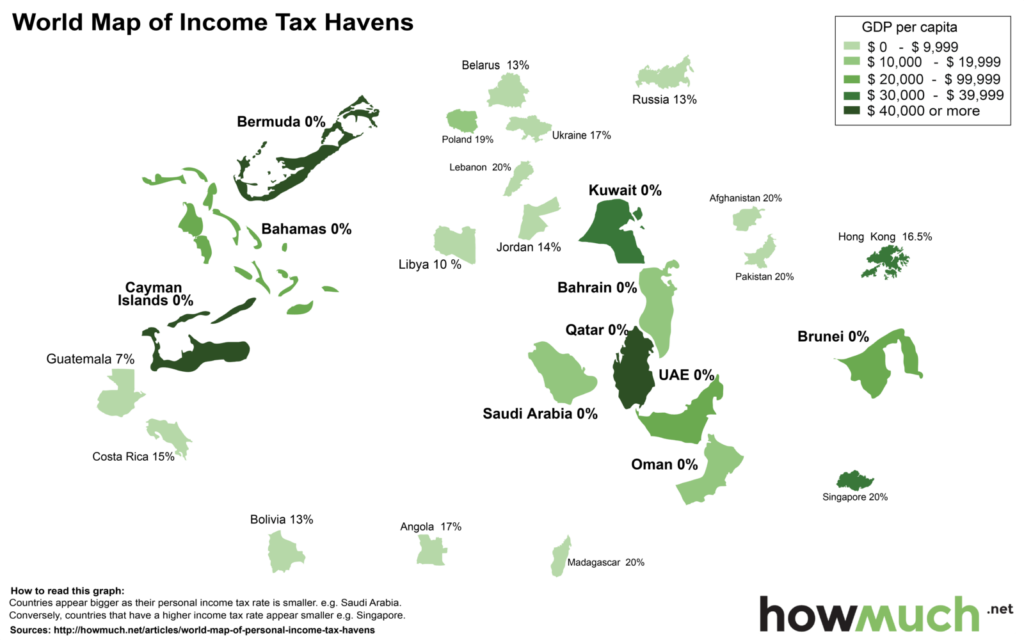

It accelerates the stashing away in tax havens of financial resources which should be invested in long term investments. It is therefore restricting the long needed reaction to climate change and to non-renewal of ecosystems.

Covid-19 pandemics is the cherry on top. It dramatically illustrates consequences of delays and cuts in all health services: personnel, equipment, supplies…

See for instance editorial in The Economist of May 9th, 2020. Summary in one sentence: Financial markets are losing contact with the real economy even faster with the Covid-19 pandemics.

Why not simply add wealth tax to income tax? This would be the best stimulus to tax evasion and optimization. For two reasons:

- Accruing wealth tax to the cascade of income tax the stockholder experienced all his career since he incorporated his business with his savings, for which he already had paid annual income tax; then hired and paid salaries to employees as well as to himself on all the outcome of their common work, skills and risk-taking, on which they all paid income tax; then paid corporate tax at company level; then contributed again through any tax on financial transactions; then paid tax on the proceeds of sales of his business or stock; then again paid income tax on his pension revenue when retired; all this obstacle race constitutes a marathon to tax havens where he, the entrepreneur and stockholder, thinks he will finally find justice.

- Meanwhile, by taxing both income and wealth, one condemns the tax auditor to a double effort: chasing evasions to income tax at home, plus chasing evasions to wealth tax overseas, eventually in over 70 tax haven nations.

Whereas, if one European country – say the UK or France or Germany… – sets the example of abandoning altogether first the corporate income tax and gradually later all kinds of private income taxes, all it has to do is audit any firm incorporated in his home country, and legislate that any unidentified Ultimate Business Owner – UBO – among its stockholders will trigger a withholding net assets tax, with a penalty of say 100%, calculated pro rata of his share in capital, which will be taken at the source on the firm’s margins, this until the UBO condescends to identify himself.

As well, said country can concentrate all its auditing resources on chasing UBOs, which means chasing only well identified individuals once discovered, instead of chasing a myriad of screen entities, anonymous trusts, investment trusts, limited liability company protected by special local laws, legislate that any discovery of fraud in UBO identification, since it would apply to the stockholder’s present annual tax statement, the previous one, the one before, and so on until reaching a date of fraud origin older than specified in Status of Limitations, would trigger an extreme penalty: Confiscation of all assets, and jail sentence. This also with severe penalties for all merchant banks, lawyers, certified accountants, auditing firms and other financial consultants and services who would have helped him setting up his tax evasion structure. To the point that the message would spread quickly that from now on providing tax evasion services has become a very dangerous game.

The same applies to any country in the world where democracy functions with a minimal corruption, meaning that The People has the unshared power to, at the end of a fixed term, peacefully fire the government and elect another.

How it works.

We promote a transition from the Income Tax (taxation of all and any income) by a General and progressive Wealth Tax paid by physical persons only. This for numerous reasons, but the crucial one is this: All Income Tax audits must be constrained by a Statute of Limitations, which prevent punitive action for fraud after a prescription period of 2 to 5 years according to countries. Whereas with a tax on wealth the fraud would be repeated each time the taxed entity files its tax statement, meaning its balance sheet, each year. Statutes of Limitations need not apply. One could legislate that a tax fraud repeated each year with origins beyond the prescription date would trigger the most severe sanctions: Confiscation of wealth plus prison terms. This is the reason why, whereas many countries practice tax on wealth and many economists and politicians recommend it, no one talks about doing away with income tax. It would mean within the foreseeable future the end of tax havens’ main reason of existence.

The abolition of Income Tax will have other benefits: For instance, it would set free very-long-term investments:(30 to 100 years, which is the scope of all investments aiming at reacting to Climate Change, to preservation of ecosystems renewal capacity, to restoring natural resources and to develop soft energies. Long term investments are all the more taxed in that all actors participating to the funding itself, as well as all actors executing the investment, pay income tax for a longer period before Return Of Investment.

The idea of abolishing all income taxes, real estate (or land) taxes and inheritance duties, and replacing them by one single wealth tax, or Tax on Net Assets[1], paid by physical persons only, seems remarkably simple.

However, it never was considered by any economist (Keynes, Hayek, Eucken, Schumpeter…) of any schools, except Ludwig Von Mises, and for the right reasons.[2] Otherwise Income Tax is considered by all economists as a given, an immutable assumption by all economics schools even though it is only one century old.[3] Income Tax is the youngest form of tax after the Value Added tax (France, 1953).

And yet Income Tax is the original cause of automatic world debt growth, of fatal increase of inequalities (revenue and wealth), of Tax Havens, of paralysis of long term investment, and, since the eighties, of the explosion of financialisation. Its consequences are complex and highly favorable. This basis of a tax reform is at the origin of Comité Bastille’s proposal: The Tax on Net Assets Project (Projet IPP/TAN in French.)

Comité Bastille, a not-for-profit think tank,was founded in Atlanta, GA, in 2006 by six French citizens then residing and doing business in the US. Their initial goal was writing down, assessing, and publishing in France, the Tax on Net Assets project on which André Teissier du Cros, a management consultant, corporate strategist and essayist, has been working on since the seventies.

In January 2010 was published by Editions L’Harmattan, Paris, André Teissier du Cros’s first book[1] on this project: La France, le Bébé et l’Eau du Bain, proposing abolishing all Income Taxes and replacing them by a tax on wealth of physical persons only, or Tax on Net Assets (TNA), or Net Worth. An enterprise of any kind would not pay taxes anymore. Its stockholders would pay it instead, but would earn higher dividends which, same as all income, wouldn’t be taxed anymore. The economic model thus made possible would make it worth their while, since the firms in which they invest would save on abolished corporate income tax and on income taxes paid by its employees, suppliers, and customers, therefore be able to invest more, especially in the longer term, and to increase dividends.

This simple but momentous structural tax reform is applicable in France, in Europe, and in any country respecting Free Enterprise and the Rule of Law. In the U. S., the 51 income taxes (50 States, plus Federal tax) could be replaced by 51 Taxes on wealth fitting with each State’s policies.

Abolishing income tax provokes the obsolescence of tax havens, since they were born in 1929[4] precisely to make possible the avoidance of income tax. It encourages long term investment and strongly discourages short term and speculative moves and positions.

In April 2010 Comité Bastille was incorporated in France as a Non-Profit Association. It had then around 100 members. The proposed tax reform project has since been approved by the Centre des Jeunes Dirigeants (CJD, Federation of young entrepreneurs). CJD, after 18 months of assessment and debates in over 30 French cities, has proposed the project in their 2012 Annual Report or Livre Blanc, published under the title Objectif Oikos, published by Eyrolles. It has reached 40,000 CJD members.

Then in 2014, it was adopted by Corinne Lepage’s political party Le Rassemblement Citoyen/CAP21 in their own program, see http://en.wikipedia.org/wiki/Corinne_Lepage, and by eight parties and movements federated with CAP21 to jointly prepare the 2017 elections under the banner La Primaire des Français.

In August 2019 Jacline Mouraud, better known because she had been, in October 2018, the instigator of the Gilets Jaunes (Yellow Vests) Movement; was officially appointed Comité Bastille’s public speaker. Her latest book Jaune… et puis après? (Yellow Vest… and then what? Pub. Editions Télémaque, Feb. 2020) gives of our tax reform proposal a simplified presentation for a larger audience.

The TNA Project has been from July 2014 until May 2017 under study by Nouvelle Voie Socialiste (NVS), the think tank of the French ‘Parti Socialiste’ in which a tax reform commission was working under guidance of Rémi D-P, entrepreneur, and Clement C., Inspecteur international des Finances, Ministry of Finances; and followed by Thomas P., a Director at the French Ministry of Budget. All members of NBS dispersed themselves with the collapse of the Parti Socialiste, but stayed as members of Comité Bastille. Thanks to the ones who are civil servants at the French Ministry of Finance, cooperation was pursued to this day. Other existing political parties and movements who are informed of the TNA Project are the Modem, EELV, Nous Citoyens, Les Républicains, Modem, PCD, the new Parti Démocrate … and the NOMES in Switzerland.

It proposes to the French a tax reform attracting since 2013 a growing attention in France and beginning to be known in the EU and in the US (see debate in Appendix.)

The Comité Bastille promotes it through a website, four books, published articles, and around 50 conferences given in various parts of France since 2010.

The six key points of the TNA Project are:

- Give the existing Conseil Constitutionnel (Constitutional Court, equivalent of the Karlsruhe Bundesverfassungsgericht) a veto right by which it will impose that the National Budget growth (growth of total of all public expenses) cannot increase by more than 50% of growth of the population before retirement age. This would mean that the French Tax Pressure (Total Public expenditure per GDP) would go from 56% today in 2015 (highest in the world with Denmark and Sweden) to 36-40% in 2050 (comparable to Switzerland or Singapore). The Constitutional Court will be alerted by the Cour des Comptes(National Court of Public Accounts), which today has all the instruments to audit the national budget and government expenditures of any kind.

- Gradual Abolition (10-year transition) of all forms of Income Tax for both private persons and businesses including capital gains tax and any tax on financial transactions, also abolition of all land taxes (Impot Foncier), and succession (inheritance) taxes. One of the consequences would be that any long term investments could be undertaken and underwritten by the Banque Publique d’Investissements (BPI) freed of any future income tax, same as practices the KfW Bankengruppen but only for specific investments.

- Gradual Extension (10-year transition) and simplification of present French Tax on Wealth (Impot de Solidarité sur la Fortune, ISF) to all individual taxpayers in the form of a progressive Tax on Net Assets (TNA), of 1.25% of said assets (net assets, or personal worth, equals book value of all that you own – gross assets – minus all that you owe – total liabilities), TNA being progressive, from 0% on the portion under €50,000 of net assets, to reach 3% on the portion of net assets over 10 million Euros ($ 11.2 million). TNA is paid by physical persons only: Enterprises of any status do not pay tax anymore.

- Take advantage of abolition of fiscal depreciation and tax deductibility resulting of the abolition of Income Tax, which will again make attractive very long term investments (VLTI, 30 to 100 years) to channel French quasi-liquid savings[5], through the BPI into infrastructure and industries of sustainable development (soft energy generation, energy transmission and storage using the Volt-Gas-Volt scheme and equivalents, energy-neutral building and housing, land recovery and forest development, bio agriculture, urban planning around electrical mobility…)This, backed by the sovereign guarantee of BPI (new Public Investment Bank)[6][3] will be proposed through a “Save to Invest” Plan comparable to the existing “Save for Home Owning” Plan. Reminder: The abolition of all form of income tax makes all tax havens obsolete. The French networth of private individuals plus private businesses amounts in 2013 to €12.6 trillion or €194,000 ($263,000) per head, and the level of thrift in France is among the world’s highest. Comité Bastille assessed that the progressive abolition of income tax will set free around €100 billion per year of quasi-liquid savings, which will be channeled all in very long term investments, creating within ten years some 3 million jobs.

- Impose to publicly-traded corporations adopting the new tax code an Ethical Governance Covenant: It would forbid buying back one’s own stock (the key to Insider Trading); and all form of stock-option compensations including golden parachutes; it would impose total transparence of management and accounting practices, and limit the highest salaries and other remunerations to 20 times the lowest salary in the same firm or business entity.

- Demographic policy pursuing support of birthrate as today (France is EU’s birthrate and population growth champion, together with Ireland), plus a proactive immigration policy aiming at an average population growth of 1%/year (The 9 most prosperous States of the US achieve twice that rate. French population growth today is 0.6%. US population growth today is 1 %.)

- This tax reform would be introduced within a transition of ten years.

- The Conseil Constitutionnel veto would come first, together with a fading out of corporate income tax within 3 years, after alignment with other European income tax rates: the German one to begin with, then the Polish one, then the Irish one which is the lowest today, and finally down to zero in 4th year.

- The TNA revenue would build up gradually, beginning with the largest personal fortunes, and going down by level of assets until, by the tenth year, total TNA revenue would reach €200-220 billion of 2013.

- Personal income tax would move down from the 3rd year onwards, reaching zero in eleventh year.

- Inheritance taxes would disappear as TNA revenue grows.

- Land Tax (Taxe foncière) would first be deductible from TNA, and later disappear as deductibility becomes universal.

- The project would of course maintain VAT, at a level never exceeding the highest rate in the EU which is Denmark`s (25%).

The announcement of such a reform would send a global signal that France can now free you of Income Tax if you come to live or invest, and is on its way to become the biggest tax haven in the world and the country the most favorable for enterprising, wealthy people, for their partners in business and for their employees, but the least favorable for sleeping assets, for get-rich-quick schemes, for publicly traded firms who want to stick to Wall Street practices, and for the professions (investment banking; auditing; corporate law; various tax evasion experts…) today undertaking the global plunder of mankind, of business skills and other forms of real goodwill’s, and of natural resources, under the flag of financialisation.

Comité Bastille is a not-for-profit association which has a bit over 2,050 participants in October 2016, of which 560 Observers, 90 active members, 10 board members, 11 German citizens (including a retired auditor of the Oberverwaltungsgericht of Saxe Länder), 8 Swiss, 2 British and 3 US French-speaking citizens, 1 Dutch, 18 elected politicians with public visibility, 2 French ex-Prime Ministers and 3 ex-Ministers, 2 retired labor unionists, around 40 CEOs, around 100 self-employed, 7 professors and teachers, 6 scientists, 11 French or European Foreign Office executives, around 40 students… and 35 journalists. The association is politically neutral with the exception that its followers are supportive of French republican institutions including laicité (separation of Religion and State, absolute freedom of opinion and conscience.) Its website www.comitebastille.org is visited 40,000 times per year at time of update.

Dr. Eng. André Teissier du Cros, born 1937 of French and Scottish parents, is a U. S. and French citizen. He lived for 26 years in Atlanta, GA, and now lives near Montpellier in Southern France.

Dr. Eng. Andre R. Teissier-du-Cros, President & Founder, Comité Bastille

Andre is a US and French citizen. He has an M. S. degree in Mechanical Engineering and a PhD degree in Materials Sciences from SupMeca, 1958-61. From 1988 to 2001, Andre was President of the U.S. Southeast Chapter of the French Foreign Trade Advisors (C.C.E.F.). He has been from 1994 to 2001 an Adjunct Professor at the Georgia Institute of Technology, School of Business Management, where he created and taught the course on Strategic Competitiveness Assessment. He was for 5 years on the board of Alliance Française of Atlanta, Georgia (www.afatl.com) and for 2 years its President. His literary works include publication of five books in France and one in the U. S.

Since 1980, Andre specialized his consulting practice in strategies for the manufacturer of industrial equipment and capital goods such as industry-specific machinery and related components, additives and ingredients, which gave him a long hands-on experience in more than 30 countries of all the vicious effects of various deductibility rules for depreciation and amortization. He has a 40-year experience in acquisitions, joint ventures, equity funding, and financing of innovation. He had manufacturing clients in 14 countries and undertook for them missions in 32 countries, some of them lasting from 7 to 21 years… Three of his past clients operated subsidiaries in Tax Havens, making him familiar with all practicalities and benefits of such operations.

He founded his firm in 1972 in Paris, France. In 1983, He moved the firm to Atlanta GA while immigrating to the US. He became a United States citizen in 1988. In ’98, his consulting practice extended into China through a joint venture with the Targon Group, Shanghai. This association led in 2008 to the acquisition by the Targon Group, Shanghai, of the goodwill of his firm.

His expertise in fiscal policies and the positive or negative influence of a tax code on prosperity, competitiveness, public health and sustainability originated when Andre held a post as Secretary & Reporter of the National Commission for Industrial Innovation appointed by Georges Pompidou, then President of France [1967-1972]. He participated in the creation of ANVAR (now OSEO), the National Agency for Innovation Funding, 1966-1975. He was Reporter of the Innovation & Technology Chapter of the Commission for French Competitiveness appointed by Raymond Barre, Prime Minister, 1979-1981. He was actively involved in the creation and management of ANCE, the National Agency for New Business Creation, 1978-1982. He undertook from 1970 to 1983 various missions for the French Ministry of Industry, Ministry of Agriculture, Ministry of Research & Technology, and City of Paris.

His 4th book (L’Innovation malade de l’Impot, Eyrolles 1980) exposed for the first time the negative effect of high tax pressure on the ability to innovate of a firm or a nation.

In 2010, It was his 6th book, La France, le Bébé et l’Eau du Bain (France, the Baby and the Bathwater) published in France after he had been established in the U. S. for 26 years, which exposed his case against all form of income tax, favoring instead a tax on net wealth (Net Assets Tax or NAT). It gave Comité Bastille its first visibility in France.

In 2016, he exposed in detail all the work accomplished by Comité Bastille in La Taxe sur l’Actif Net ou Impôt Progressif sur le Patrimoine Dormant (Tax on Net Assets, or Progressive Tax on Inactive Assets). This was the occasion of a public conference on tax reform on March 16, 2016, gathering 55 personalities and decision-makers. Michel Rocard, ex-Prime Minister, ex MEP, commented on the TNA Project. Corinne Lepage, ex MEP, ex Minister of Environment, made the closing speech.

Andre is an FAA licensed IFR private pilot. He was for 6 years a member of the U. S. Civil Air Patrol. He has three daughters and six grandchildren.

_____

WHAT WE BELIEVE

DECLARATION OF PRINCIPLES AND VALUES SUPPORTED BY COMITÉ BASTILLE

Declaration of fundamental values which we, members and friends of Comité Bastille, support through our proposals, research and assessments.

We propose, for the concept identified by the word Politics, Hannah Arendt’s definition:

» Politics exists because of the biological necessity by virtue of which all human beings need each other to bring to a successful conclusion that difficult task consisting in merely staying alive. »

WE BELIEVE THAT HUMAN DIGNITY IS NOT NEGOTIABLE.

- We believe that human Dignity is an inalienable right that no political, economic, religious, community or other power, has the right to threaten, as Simone Weil advocates in stating: Duties towards the Human Being have priority on Human Rights.

- We believe that the only absolute values, recognized by all human wisdoms, religions and philosophies, and independently of each, are the search for Truth, the upholding of Equity, and the exercise of Benevolence, a term that encompasses solidarity, graceful mutual aid, hospitality, empathy, forgiveness, good faith, good will, fraternity, and their synthesis: compassion; and that we can also call the negation of indifference.

- We believe that it is individual Freedom, such as defined within the framework of Article 4 of the Declaration of the Rights of Man, which only can effectively lead the search for Truth.

- We believe that it is Equality before the Law, of rights and chances, including limits to inequality of material conditions, which only can effectively lead the search for Equity.

- We believe that a society which does not take care of the weakest of its members is in danger. We believe that Brotherhood, or Fraternity, is the guiding thread in the heart of institutions leading the progress of benevolence.

- We believe that any State, whatever it is, has a power which extends and limits itself to all that its people choose to define as the public good, the general interest, the common wealth, the Res Publica; that to that effect the State is subject to the Rule of Law, that it must organize electoral contest in a transparent way; it must assure that the Rule of Law be sovereign on political power; it must maintain separation of its legislative, executive and judiciary powers; let the elected majority form the government; protect elected opposition by facilitating the play of power alternation, and strictly enforce separation of Religion and State. In that respect, we are firm defenders of Social Democracy. We believe that a Republic must first respect these principles of government, limited by sovereignty of the people, and freedom of the individual beyond the reach of government in his private life. Thus, in an etymological sense, we are democrats and republicans.

- We believe that the most vital freedom is freedom of thought: opinion, belief, faith, conviction, adhesion to a school of thought, and search for epistemological knowledge of facts. Individual thought must therefore be beyond the reach of all power. This principle is called Secularism in English, which has a more restrictive sense than Laicity in French. Laicity forbids interference of any religious law or duty with politics. We believe that a true Republic and a true Democracy can only be laic.

- We believe that in a laic State defining a framework of rights and duties, every resident on the national territory, regardless of nationality, ethnicity, language, sex, age, legality or otherwise, has the same universal rights, and that therefore:

- he must never be penalized, judged, punished, ostracized because of who he is, what he believes, or what he has ceased to believe (apostasy);

- his right of residence can only be challenged for judicial reasons on its own;

- If he commits a crime or offence, he must be treated as a criminal or delinquent, but not as a foreigner.

- We believe, as a corollary, that he must impose duties upon himself: to respect republican law without exception, to integrate into society by publicly respecting its mores, habits and customs, to strive to be recognized as a full member of society.

- We believe that the most vital freedom is the one to dispose of one’s body within respect of others and of public order. Thus, we believe that a woman has sovereign power over her foetus in any case up to twelve weeks from conception. We believe that she has the sovereign right to have as many children as she wants or not to have any. We believe that the sexual practices of consenting adults in a private setting are not the business of any third party, constituted group, political or religious power.

- We believe that Democracy has been misappropriated, by being invoked too often in vain. We have forgotten that the call for sovereignty of the people must be a last resort, when the group of decision-makers cannot reach unanimous consensus and more generally when subsidiarity, i. e. the delegation of powers to the lowest possible level, is in failure.

- We believe that dignity of human beings and sustainability of their existence also require respect for all forms of life and therefore preservation of ecosystems, of natural virtues of plant and animal, air, water and sea quality, of energy and health sources, which must take priority over economic and financial interests.

BY VIRTUE OF WHICH!

- We believe that the State has a duty to support life expectancy and integration for all through compulsory and free public education, favoring greatest opportunities for professional and social development of all.

- We believe that, as stated in Article 13 of the HRD, we must once again restore overall progressiveness to our tax and levy system and therefore tax the richest [1] more rather than those who are trying to improve their condition; that income tax is therefore an economic crime because it punishes the work, imagination, responsibility and knowledge of the profession by which an individual contributes to the well-being of society while improving his own; because it is the easiest and least dangerous to defraud; and because it handicaps the company in its efforts to invent, invest, train its employees and ensure its survival.

- We believe that a State of Law needs to raise taxes in order to function, and that paying taxes is an essential civic duty and not a punishment; but that a government has a duty to allow itself to be imposed budgetary discipline [2] within a framework defined by the Constitution and an organic law [3].

- We believe, like Adam Smith, founder of Liberalism [4] that a company employing permanent employees should not have the right to raise equity capital on the stock market (issues of common shares); only to issue non-voting shares known as preferred stock, and to engage in bond issues. The corollary is that we believe:

- In co-management of companies,

- In fair redistribution of results between employees and shareholders,

- In the necessary regulatory action of the State against trusts, insider trading, oligopolistic cartels and any other form of anti-competitive practice, and also in its duty to protect public and private wealth.

- We believe that the publicly traded company should not have the right to repurchase its own shares, nor to remunerate its managers by stock options and golden parachutes [5].

- We believe that Value Added Tax (VAT); Progressive Tax on individual Wealth especially when it is unproductive, known as PTW (IPP in French) ; and all bio-taxes on energy, on externalities [6] and on products of critical ecosystems, ensuring their renewal as well as preservation and protection of the air and water quality, are the only three forms of virtuous taxation.

Signatories : (in alphabetical order) Isabelle Abric, Louis Bériot †, Louis Berreur, Bruno Botto, Christiane Brochier, Roger Brunelli, Jacques Bucki, Rémy Carrodano, Clément Carrue, Christian Cazauba, Marie Dalbard, Michel Duhamel, Dominique Giocanti, Antoine Héron, Nicolas Jouve, Jacky Leccia, Marie-Claude Lemoine, Huguette Maréchal, Michel Meunier, Jean de Monbrison, Jacline Mouraud, Peter Paulich, Dominique Pérot, Florence Pézennec, Éric Poujade, Jean-Michel Quintric, Jean Rapenne, Olivier Rolot, Jean Sagnol, Antoine Sfeir †, André Teissier du Cros, Jean-Jacques Thiebaut, René Van Soest, Jean-Paul Vignial and Éric Wallez.

1] We define being rich as a state that allows the holder to live comfortably off the income from his assets. It begins when the taxpayer’s assets (his Net Assets) exceed ten million Euros, 2017 rates.

2] Note: Budget discipline does not mean balanced budgets.

3] Organic law: Law establishing decrees for the implementation of an article of the Constitution.

4] Liberalism advocating freedom of enterprise and free trade in goods and services, but rejecting what gave rise to Financiarisation, commonly and incorrectly called neoliberalism.

5] As was the case before the 1980s, when financial markets were highly deregulated.

6] Circular VAT, VAT including energy consumed and equivalents.

What I foresee for the next hundred years is:

Mankind will be more and more pushed towards a synergy of nature and human progress, instead of the four-centuries-old belief that Man is created distinct from Nature and called to dominate it. For instance, instead of world population growing as the tree population is falling, I foresee a development in which the ratio of weight of live trees to weight of human population will be maintained constant, in order to store fresh water and stabilize climate. I hope that in 2119 reforestation will have reclaimed some land from the deserts…)

Political institutions will further develop social democracy, following the Walter Eucken Rule adapted to our times: Free enterprise as much as possible, State intervention as much as necessary to preserve Human Dignity and Life Diversity, which are not negotiable. Said institutions will promote the principle of subsidiarity: Any political decision should be taken at the lowest level possible.

Taxation will move away from Income Tax, to be progressively replaced by Tax on Wealth of physical persons only:

- Tax on wealth taxing notably business stockholders at level of Market Value for publicly traded companies, at level of Net Assets value (book value of stockholders’ Equity) for private businesses.

- Value Added (or consumption) Tax, integrating tax on consumed energy and critical natural resources.

- Social Protection Contribution.

Mandatory three-tier social protection (health care, old age pension, unemployment insurance) managed independently from Government (most probably through a Board representing business, labor unions and State, aiming at extension of life expectancy first.)

Mandatory and free education until age of 16, with federal standards for general and professional education controlled through strictly anonymous exams. (In the US a good example is FAA’s rules, procedures and standards for aircraft pilot training: a commercial pilot is a commercial pilot, whether he got his license in Mississippi or in Massachusetts.)

Universal Basic Income of approximately half the Minimal Wage, paid to all citizens without any distinction above age of 18; and of a quarter of Minimal Wage for each dependent child.

Return to Glass-Steagall Act separating Investment Banks and Deposit Banks at stockholders’ level.

SEC and other financial practices regulation forbidding Buybacks, Stock-Options and Golden Parachutes. All publicly traded companies the business of which is public services (water, energy and telecom services, public transportation, health care, life and health insurance, etc.) will abide to a salary level rule by which the ratio of highest salary to lowest salary in the same entity should not exceed a multiple of 20

Questions from American and British audience:

Ian W., Nov. 3: Andre, I am still reading and pondering. One question that arose in my mind: Who is in charge of deciding what a person’s asset level is? As we have come through the economic decline in the US, ones assets have been, to say the least, fluctuating. For instance, a home that would have been valued at 500K in 2000 may be valued at 200K today. Actual cash is what it is but stocks, bonds, gold, etc. have risen and dropped on an almost daily basis. When is one’s assets priced and what happens if the liquidity of assets is low when one must cash in to pay the TNA? I fear this might have the same sort of gotcha’s that a flat tax presents. There will be more.

Andre: Here is the beauty of it: Who is in charge is the taxpayer himself, who uses good will, common sense and basic, public information source to appraise his home once every 5 years at least, and volunteers to do it sooner in case of a cataclysm like 2008-09. He will be encouraged to input a short statement (such as the one you just did) explaining how he assessed the figure, and he may add a report from a Notary (for France, Germany or Scotland) or Certified Accountant or Real Estate Auditor if he wishes, but it won’t be mandatory. What will be opposed to him in case of audit is his tax statements (i. e. his balance sheets) of previous years. If he has a piece of land that he values at $10,000 and two years later sells for 200,000, malicious fraud will be more or less obvious. (I never met an American or a French or German homeowner who didn’t know how much its home is worth.)

If he owns stock in a publicly traded corporation (including a fund of course), he computes the average market price of the stock during the last 3 calendar years.

If he owns stock in a privately held business, the worth of his stock is directly the net assets (stockholder’s equity) in the firm’s balance sheet. As stated in the books. It never is the market value of the business.

If he owns any asset in a foreign country, including on the moon when the case comes, he declares it according to the same rules. But if he doesn’t declare it, fraud on TNA will be criminalized and the penalty will become exponentially severe as year after year he forgets to declare it. And since there will be no more income tax this will be The End of the Tax Haven. Remember that Tax Havens were created by a Bill of the UK House of Commons in 1929 when the status of the offshore company was made legal. This was 15 years after the general introduction of income tax: 1914.

Byron G. Andre, I have many questions for you but let me begin with this one: Under the current system my TANGIBLE asset values are appraised and taxed by the State and County in which I reside! The revenue generated is used to fund local projects and community needs….including Public Education. Would not the TNA proposal necessitate a move in the direction of a State Administered Public Education system such as you now have in France! “All educational programs in France are regulated and administered by the Ministry of National Education. The teachers in public primary and secondary schools are all State Civil servants and Professors and researchers in France’s universities are also employed by the State.”

Andre: Thanks, Byron. The way each level of local government uses tax revenue is not the object of our reform. TNA is applicable in the US. TNA could be collected for instance at the State level, a percent of it being transferred to Federal level and another to County level. Government appraisal of any property would be abolished: The basic citizen becomes completely responsible of home value assessment. Other assets than real estate are business assets appraised as exposed before.

Jan W. You have a great deal more faith in your fellow man than I. I cannot imagine the vast majority of US citizens voluntarily assessing then paying their taxes. Didn’t Europe has trouble in the past with citizens refusing to pay what they owed?

Jan, you ask 2 questions.

1). I have never noticed either in the US or in France or Germany that citizens refused to pay taxes due. The system doesn’t suppose that citizens would accurately assess their assets. You need to assess a good when its value is for some reason questionable or inaccurate. The system doesn’t ask for accuracy but for good faith. The taxpayer will state a value at a conservative figure, and the IRS will not question his figure unless there are tangible reasons to suspect malicious distortions of figures or complete omission of certain assets. (For instance you say that your house is worth $150,000 and next year you sell it for $350,000.) And that will be analyzed by the IRS comparing your statement of this year with previous year’s statements (Watching for instance to assets which have been sold in-between, and at what price; or for assets which should be declared and aren’t at all.)

2). at this moment, Europeans are not refusing to pay their taxes. There is no massive default reported. But yes, Europeans do complain rightfully about tax pressure becoming too high. This is why people like us are proposing a complete overhaul of the tax system.

Byron G. Yo Andre! Having done a little research into the French Tax system I can readily see why you and your cohorts see a need for MAJOR tax reform in France! Tax rates in France are different and generally higher than most other countries. i.e., In most English-speaking countries (e.g. UK, USA, Canada) income tax and social taxes are calculated on an individual basis. Is it true that in France Taxes are calculated on a family basis and the income for all family members is added up and then divided by the number of people in the family? If this be true then I consider it Socialism at its most fundamental level! But, it is not my intent to nit pick! The major problem for me is that, as I understand it, TNA allows the federal government a power that they do not currently have….DIRECT access to my TANGIBLE assets for taxation purposes regardless of WHO does the value assessment! But, maybe I have it wrong! Be patient with me! I’m doin’ my best to get up to speed!

Andre: 1). Yes, what you say of income tax in France is true. Whether it is socialist or not, our plan will get rid of it since we simply abolish income tax.

2). Tax rates are somewhat different in each country. But all countries, US included, practice 4 kinds of taxes: On income, on sales or transactions, on assets (ex: succession duties, land and real estate tax…) and social charges (US Social Security).

The TNA Project is completely new compared with anything existing in that it abolishes all kind of income tax, and compensates them by one single tax on net assets. Tax Pressure difference (Tax Pressure, total tax income of any nature divided by GDP which has nothing to do with tax rates) between Europe and the US is diminishing: The US figure used to be (1980) some 35% when the French were at 44%, and is now getting close to 40% (says IMF). same as Switzerland. The highest tax pressure is in Sweden and France: 46%. All the others are intermediates between these figures. Ex: UK 44%, Netherlands 42%…

3). No, TNA doesn’t give Federal government any new power, on the contrary it lets the taxpayer freely (but honestly and sincerely) declare his net worth, takes it for granted, and waits for next year’s tax return to check for inconsistencies.

Byron G. Andre, I foresee what could be a major impediment to the implementation of TNA here in the U.S.! It is called States Rights! Unlike French Departments, States have Constitutions which empowers them to assess taxes. The States will be reluctant to surrender this power which would leave citizens faced with a DOUBLE TAXATION scenario!! Also, I am curious to hear from our members who live in States with NO income tax or capital gains taxes. i.e. Alaska, Florida , etc. Tax revenue in these states is generated by taxes on tangible property, sales and use taxes., and various excise taxes among others.

Andre: Good point. German members of Comité Bastille said the same. I would suggest to operate the German way. In Germany the Laender are equivalent of US States, and the constitution is truly federal. The Laender collects all taxes! So it will be the State that will collect all the NAT, and same as in Germany the State will pay up to the Fed the portion of TNA that contributes to Federal expenses. By this way States will recapture some of their sovereignty. Won’t you like that?

In Florida, Alaska and similar it will be easier since there is no State income tax to abolish. But their citizens do pay Federal income tax, which will be abolished. Alaskans who pay property tax will see that tax AND the Fed income tax replaced by Net Asset Tax, whatever is the nature of property.

Byron you also asked me to whom do you pay your tax. When I lived in the US I paid in Georgia a State tax and a Federal tax, same as most States I suppose. Now all US citizens will pay 100% of their tax to their State, period.

Now, BIG Forum hasn’t noticed the main consequences of the TNA Project: Today in the US, in Europe and in Japan, most of income tax is paid by the middle class and by the small and midsize business. Publicly traded corporations and their very rich stockholders have ample tools to practice tax avoidance or evasion, and the richest people are getting richer at the rate of 5 to 15% a year according to countries, while the mass of the population see their purchasing power flat or diminishing. This is a fact recognized even by the IMF (I asked directly the question to John Lipsky, who has a home nearby) and he recognized the fact. With NAT, the richer you are, the more you pay, period. This is not blaming the rich: More and more very wealthy people have publicly stated that this state of things cannot go on. Hank Paulson for instance.

Feb. 23, 2014. Jan Whittle We have gotten the government we have continued to elect over the past 50+ years. We whine when a bureaucracy gets out of hand but forget that it was born out of a need at some time past. Once a department is established, it begins to assume a life of its own and the rice bowl grows and grows. The TSA is a prime example of what can and will go wrong. Bush created it in order to « stem terrorism » in the country. There was already a network in place to do just that and, for whatever agenda, it was deemed more important to create a new arm of government. For quite a few administrations back it became « cheaper » to contract out military jobs rather than keeping them within the military purview. Today, we are faced with a mercenary group only controlled by the corporation hiring them.

Welfare has been used by both parties as a carrot to dangle before elections. Each side angling for votes from specific groups. The original welfare plan has been so co-opted that it lost its « Hand up » to « Hand out ». There will always be a need for welfare in the US but should not be a way of life for anyone.

Fear and hate work well with people. They can be convinced of almost anything if the right words are attached to the pro or con side of the issue. Hate is used to make « us » feel good about attacking « them » (blacks, orientals, mid-easterners, democrats, republicans, jews, any religion not mine, rich, poor, northerners, southerners, and on and on) . Fear is used to make it OK to curtail our freedoms and privacy in the name of protection from terrorism. I have been appalled since 911 how easily the American people are convinced to turn a blind eye out of fear of « invading » forces lurking behind the trees. How much blood was shed during the 70″s making wire tapping illegal and forcing police to get warrants to break down someone’s door? The TSA and Homeland Security have been given free rein and people are « feeling safe » with the situation. We forget that the focus can be turned at any time towards the finger pointers today. Power corrupts and total power totally corrupts.

War and destruction are narcotics to people seeking money. It is a never-ending font of money rolling into the tills. Our minds are limitless in the ability to wage war and create new weapons. Politicians load up their pockets by forcing boondoggles for sugar daddies in their districts (this fighter jet that is 6 years behind schedule and billions of dollars in debt is a great example). All services have been forced to accept equipment that they don’t want, need or like because some Congressperson owed a favor (jobs for the district excuse).

I’ve run on long enough. Yes, the government has its nose into way more that it should and isn’t as involved in many of the things it should be. We only have ourselves to blame for this and it will continue as long as we keep the same attitude current in our society. Until we forget about a person’s party and begin to listen, educate ourselves and focus on the real issues that are imperative to the functionality of the United States, this condition will thrive.

Andre Teissier-du-Cros I fully agree with Jan Whittle, excellent analysis. But note that this is not America’s problem, it is the problem of all developed democracies. Which is why I think that a structural reform of democratic institutions, of tax codes and of the way the Rule of Law is practiced is ultimately unavoidable, and is in the making.

March 13, 2014. Sent: Thursday, March 13, 2014 5:16 PM

Subject: Look at this to see the hidden but constant bad side of neoliberalism…

Its nasty effects always appear too late, when the harm is done. And it’s too late for the media to take notice because it has become old stuff.

What BoE Governor Mark Carney did to Canada, he is doing it now to the UK who certainly didn’t need it.

http://www.huffingtonpost.ca/2014/03/12/mark-carney-canadian-economy_n_4951275.html

Keep this in mind (Watch out this is only external debt, in 2013):

| Rank | Country | Debt – external (Billion US$) |

| 1 | United States | 14,710 |

| 2 | United Kingdom | 9,836 |

| 3 | France | 5,633 |

| 4 | Germany | 5,624 |

| 5 | Japan | 2,719 |

| 6 | Italy | 2,684 |

| 7 | Netherlands | 2,655 |

| 8 | Spain | 2,570 |

| 9 | Ireland | 2,352 |

| 10 | Luxembourg | 2,146 |

| 11 | Belgium | 1,399 |

| 12 | Australia | 1,376 |

| 13 | Switzerland | 1,346 |

| 14 | Canada | 1,181 |

| 15 | Sweden | 1,016 |

| 16 | Hong Kong | 903.2 |

| 17 | Austria | 883.5 |

| 18 | China | 697.2 |

| 19 | Norway | 644.5 |

| 20 | Denmark | 626.9 |

| 21 | Greece | 583.3 |

Le 14/03/2014 10:00, Nigel Richardson a écrit :

Andre,

While not entirely in agreement with you, this is great stuff.

It is difficult to understand how the UK population of 64 million supports an external debt of $9.8 trillion when the US’s 320 million has only $14.7 trillion and France’s 64 million has $5.6 trillion.

Nigel

Andre answered:

The truth is: It is relatively meaningless if you don’t add the internal debt (debt of the State to local lenders, which for instance brings Japan’s total debt to more than 200% of GDP), and the private debt.

If you do that, the US situation is much more alarming (only US students carry a debt of some 1.2 trillion, see http://www.forbes.com/fdc/welcome_mjx.shtml)

The French one is much less than it sounds in the media because the bigger part of French pension funds is not capitalized being based on immediate redistribution (répartition – John, age 30 pays 10,000 € of pension contribution which is used this year to pay 10,000 € to Pierre, aged 70…) and yet they can be assessed, using life expectancy and base interest rate. In that case, French economists state that net asset per tax payer, already high, increases by some €75,000. French private internal debt is 12% of GDP which is small. In fact one part of our TAN Project consists in playing the Japanses game and floating a huge long term loan collecting French savings to invest for the very long term. But before suggesting that we recommend creating a sovereign veto right managed by the Cour des Comptes (Court of national auditing which does a very good job…). This veto would impose that budget deficit and debt would be rolled back gradually and later that Tax Pressure (the highest in the world otday) would be gradually rolled down to 40% GDP. See our page in English at:

https://docs.google.com/document/d/1Ij1mXpQ10BzN_nM47WJ8wqmMC6mS5cEJVEcdqo4VORM/edit

In other words, France is a very rich ageing man, half asleep, who doesn’t care getting just a wee bit more into debt because he has strong assets, nor putting his money to work because he generally (for good historic reasons) doesn’t trust his government, nor other governments, nor the stock market. A bit like W. C. Fields stating that all his resources were safely invested into cash.

My impression about the UK is that:

- Some foreign debt corresponds to UK-based foreign companies (Arabs, Russians, other Europeans…) using their British operations (or holdings) to contract debt overseas?

- Lots of retired people carry a mortgage on their homes, some of which is « toxic » such as variable rate with strings attached, pay interest only, etc.?

- Same as France or Spain, UK has converted industrial assets into real estate assets through « financiarization ». But French real estate prices are flat, Spanish ones have collapsed, while British real estate is still bubbling up, fed by foreign fear. For how long?

Andre

- Byron Godwin: Andre, as I have previously indicated to you, I agree that a totally new tax system could prove to be more equitable to the tax payer (Business and Individual). However, I believe that a major overhaul of the existing U.S. Laws would be a more logical step than would be the implementation of a totally new system simply because the overhaul is more easily and more expeditiously accomplished. Time is of the essence ’cause the woods are BURNING! However, neither approach makes much sense without a concomitant reduction in Government’s insatiable desire to spend more revenue than it collects regardless of the system employed to collect said revenue. To me it’s a question of priorities!.

- Anyhow, I’m in over my head!! The revelation of my soul on this forum coupled with our pleasant though brief personal time together must surly have convinced you that I am a hopeless “Right Brained” dreamer and therefore ill equipped to offer any meaningful opinion on your TAN project. In my endeavor to better understand the TAN concept I ventured into what for me is unknown territory. I am currently mired in the “swamp” of Keynesian economics! Thanks a lot!!!

- Jan Whittle: Andre, I am currently reading Piketty’s book. He appears to have done extensive research into what he is writing. Checking out the research background seems to suggest that he has been doing his homework. I would think in this age of computers, it will much easier to compile facts and figures in the future. I’ll discuss the book when I finish.

- Andre Teissier-du-Cros Jan, I know Piketty (he read my book) and agree with him 50% (he supports a net assets tax). He hasn’t understood why the income tax is vicious. Byron, there is no need to create a new system. The TNA can be inserted within existing tax code and all you really have as a big change is the abolition of existing taxes. As for controlling government spending we propose something better than the German Constitutional Court which already has a veto right on total taxation. The veto would be a privilege of the French Court of Accounts (Cour des Comptes) which already is doing the audits and knows where the money is going, only nobody listens to its recommendations…

- Byron Godwin Andre! In regard to control of Government spending? The Cour des Comptes is currently impotent in that regard. TNA would empower that body to exercise such control? The U.S. Constitution does not provide for such a Court (nor that of the German Constitutional Court)! I envision a Constitutional issue here!

- Andre Teissier-du-Cros (May 2, 2014) That’s right: the Cour des Comptes is an auditing agency, but has no enforcement power. The German Karlsruhe Constitutional Court has that power. In the US, only the Congress can impose limits to budgets but instead of simply enforcing a quantitative limit to the budget and the debt the Congress takes this opportunity to meddle with other issues such as abortion, health care and others unrelated to the point at issue: $Money$. An elected government must be left free to execute the policy he was elected for. We would give the Cour des Comptes such a power, with cap figures geared to slow but sure reduction of deficit, then of foreign debt, and finally of reducing total tax pressure; in that order. Our reasonable goal would be deficit brought inside a limit that would be more severe than the one of 3% imposed by the Maastricht Treaty (and adjusted to real active population growth and to real long term public investments) in ten years, a foreign debt reduced from 90% to 50% of GDP in 17-20 years; and reducing tax pressure from 46.5% today to around 38% in 25 years. That is the hardest, and needs a time span of one generation (i. e. 25 years) to be feasible. You are right that in France we need to pass a law to create this veto right but our legal counsels say we don’t need a constitutional amendment because existing constitution already implies that budgets are balanced. In the US one may need an Amendment but why not? It won’t be the first one… That’s what keeps a Constitution alive and legitimate.

- Byron Godwin Andre! “all you really have as a big change is the abolition of existing taxes“. If that does not create a new tax system then I’m surely missing the point! Hell, I’m totally confused! So, we’ll be like that ol’ termite eatin’ a stump…one bite at a time. Put on your Professorial hat! How does the implementation of the TAN concept effect the 16th amendment and the power of the Congress to levy taxes on income?

- Andre Teissier-du-Cros Byron, rf 16th Amendment: I would recommend that the Property Tax, which is a tax on assets, and any succession (inheritance) tax also a tax on assets, be abolished by steps and replaced by steps (10 years timespan) by the Tax on Net Assets, which would also extend and grow gradually to the whole population of taxpayers above a net asset (assets minus debts & liabilities, all assets included) of, say, $50,000. TNA would grow by steps according to total net assets from 1.5% up to 3% for the amount superior to, say, $10 million. Also, this is unrelated but the Sales Tax practiced in all or most states be abolished to be replaced by a Consumption Tax or Value Added Tax, the proceeds of which to be split between State and Fed.

- Byron Godwin Andre, while I agree with many of the new and innovative concepts contained in TNA, I fail to see how it can be implemented in the U.S. as currently proposed without amending the Constitution. I think it quite possible to achieve many of the goals of TNA by concentrating on those elements that can be implemented within the limits defined by the Constitution. After all, most of the problems associated with our flawed tax system were created through the legislative process and can be rectified through that same process. With all due respect, your comment: “In the US one may need an Amendment but why not? It won’t be the first one… That’s what keeps a Constitution alive and legitimate.” left me nonplussed! I am one of those who firmly believe that the Constitution should only be amended when all other avenues for addressing a nationally compelling issue have been exhausted.

- As you and I have discussed previously, there are many “hot button” issues being discussed here is the U.S. Some are divisive. Some of these divisive issues can be resolved through the actions of one or, acting in concert with, the other TWO branches which constitute our form of Government and whose responsibilities, duties and, POWERS are clearly defined and delineated in the Constitution. Like many others I have at times found that Constitution to be an impediment to my personal agenda! At these time I step back and remind myself that it is no accident that the U.S. Constitution remains the Oldest Democratic Constitution in the world.

Andre Teissier-du-Cros Objection, your honor! The Swiss confederation has been a democracy since the Oath of Schwyz, 1293, and Iceland was a parliamentary republic without any executive branch as early as 10th century. Their parliament, still called the Althing today, originated 11 centuries ago. In fact Magna Charta (1214) was suggested by the English barons as a “return to the old Viking law…” And the 1688 Bill of Rights clearly gave real political power to the British chambers. Also the Dutch Republic (United Provinces) was founded in 1581 with a parliamentary regime which has quite smoothly functioned since.

Amendments: Of course I agree with you, better avoiding it as long as possible. But things and people change… So, in 1951 the US Constitution had only 21 amendments and now has 27, the 27th being “about Delays laws affecting Congressional salary from taking effect until after the next election of representatives.” (A good one, although one wonders if you really needed an amendment for that…)

As for would TNA be adopted in the US, it’s the same as in France, it won’t, until there is no choice because of a general bankruptcy of the State. France adopted the VAT in 1953 for this very reason: There was no alternative. It may require an amendment. In France, which has the highest tax pressure in the world, the question is getting hot…

But we have a more fundamental argument: All democracies from Switzerland to the US to Germany to France to now Spain have functioned thanks to a slow but regular increase of tax pressure (ratio of total tax revenue to total GDP). Because a politician cannot get elected or reelected without making promises that will cost money. With our sovereign veto from an independent court, democracies could at last learn to govern within a receding tax pressure. Think about that…

July 2014

Letter to Garett Jones, George Mason University

Sir,

I refer to your paper in Reason Magazine (September issue) on Thomas Piketty’s Capital.

I share with you the conviction that the successful entrepreneur deserves to get rich when his enterprise creates wealth, which can be reflected by better living conditions for his customers, his employees, his suppliers, and higher overall tax income contributing hopefully to the common wealth.

But I don’t think one can deny that, in all developed economies, the condition of the immense majority of the population has not improved or got worse according to countries; that, only in the US, effective purchasing power and economic security has deteriorated since roughly 2000, while basic infrastructure (roads, bridges, sewer systems, energy networks, water availability) has decayed; and so has quality of education except for those who can afford increasing tuitions or for students willing to begin their active life with a ton of debt. The hard fact allowing to measure this general trend is that life expectancy in the US is roughly three years less than in Europe or Japan, while, in 1937, despite the great recession, it was two years more than in France. This is where we consider that Piketty and his team have done a very useful work, showing with facts and figures that, in all countries practicing free enterprise and free markets where economic history is known, inequality of conditions tend to grow, this however being less true in the countries among them which practice so-called Social Market Economy (or ordo liberalism or Walter Eucken’s Soziale Marktwirtschaft): Germany, Switzerland, Scandinavia, Austria…

Now, here is where I disagree with both Piketty and you: Adding a wealth tax to the existing income tax system will certainly only make things worse. But we at Comité Bastille demonstrate that replacing gradually all income tax by a tax on net assets paid only by physical persons, and thus doing away with all corporate taxes (the firm pays no tax, only its stockholders do), would at same time reduce inequality, boost general growth with well being, and set free the very-long-term investments which are necessary for long term infrastructure and for ecological safety of our planet.

In other words, set the mass of population free to get richer simply by no more paying income tax, while the ones who are already rich are encouraged to get the most out of their assets.

Yours sincerely,

Dr. Andre R. Teissier-du-Cros

President, Comité Bastille,

REASON subscriber since 1976.